Net income (also called net earnings or net profit), on the other hand, shows the total remaining revenue after all expenses are paid.

#NOI CALCULATION DEPRECIATION SOFTWARE#

NOI also excludes depreciation (the distribution of the cost of tangible assets such as vehicles or machinery over their expected lifetime of use), amortization (the allocation of intangible expenses such as software or licenses over the life or license of the product), or any other expenses that will eventually have to be accounted for to find out the figure on the bottom line of a company’s income statement (its net income). NOI ignores any extra cash reserves or interest on debt due to financing decisions. For more information, please see our Privacy Policy Page.NOI deals strictly with the amount of revenue a property generates through rents and other fees and subtracts how much it costs to keep the property generating that revenue.

#NOI CALCULATION DEPRECIATION FREE#

Our affiliate compensation allows us to maintain an ad-free website and provide a free service to our readers. This can affect which services appear on our site and where we rank them. While we strive to keep our reviews as unbiased as possible, we do receive affiliate compensation through some of our links.

Our mission is to help consumers make informed purchase decisions. Clarify all fees and contract details before signing a contract or finalizing your purchase. For the most accurate information, please ask your customer service representative. Pricing will vary based on various factors, including, but not limited to, the customer’s location, package chosen, added features and equipment, the purchaser’s credit score, etc. There may be some special circumstances and exceptions to the rule, so you’ll want to keep that in mind when making investment financial decisions.ĭisclaimer: The information featured in this article is based on our best estimates of pricing, package details, contract stipulations, and service available at the time of writing. In general, the items listed above should almost always be excluded from net operating income. Common examples of tenant improvements include construction costs within a tenant’s usable space (the actual space they occupy) used to make the space functional for the tenant’s specific use.

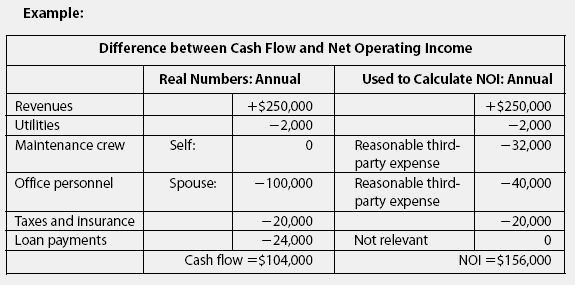

Common examples include air conditioning repair, or a roof replacement. Reserves are special funds set aside for future major repairs or maintenance. Fees paid to real estate agents or brokers are known as leasing commissions. Income tax is another figure that is specific to the investor or owner and should not be included when calculating NOI. It’s the total cash required by the investor or owner to pay back debt obligations. Debt service is a financing cost that’s specific to the investor or owner and should not be included in NOI. Depreciation isn’t included in the NOI calculation because it’s not an actual cash outflow, but rather an accounting entry.ĭebt service. Typical operating costs include management fees, utilities, janitorial fees, insurance, legal services fees, and general maintenance repair fees.ĭepreciation. Capital expenditures are improvements that the property owner decided to make, wholly or partially, in the premises-such as replacing an air conditioner, or carpeting. The total operating expenses include costs from regular maintenance and property operations, but exclude capital expenditures. However, other sources of revenue can also include laundry service, parking fees, concierge service, vending machines, paid fitness classes, and other services offered on premises. For example, a rental property’s main source of revenue is rental income. The total income includes all possible streams of revenue associated with the property. Investors use the net operating income formula figure to determine the profitability of a property and to help make investment decisions. In real estate, net operating income (NOI) is the total income of a revenue-generating property, minus the total operating expenses.

0 kommentar(er)

0 kommentar(er)